After undergoing personal bankruptcy, it can take a fair bit of operation in order to bring your support once more. There might be locations that hesitate to lend you any kind of money as a result of your past experiences. Even so, you must aim difficult to once again accumulate your area in culture as a trustworthy and able-bodied individual.

There are numerous issues that require to be resolved after bankruptcy. First, you'll require to take some finances in order to go additionally than your present state. Although it might be challenging, financial institutions are much more ready to pay attention to what you have to state nowadays. If your insolvency is for a legitimate reason as opposed to "Oh, I'm a shopaholic", after that they'll be reasonable and also effectively consider providing you financing. It won't be the most convenient process to go through, yet as long as you're honest, you have absolutely nothing to shed.

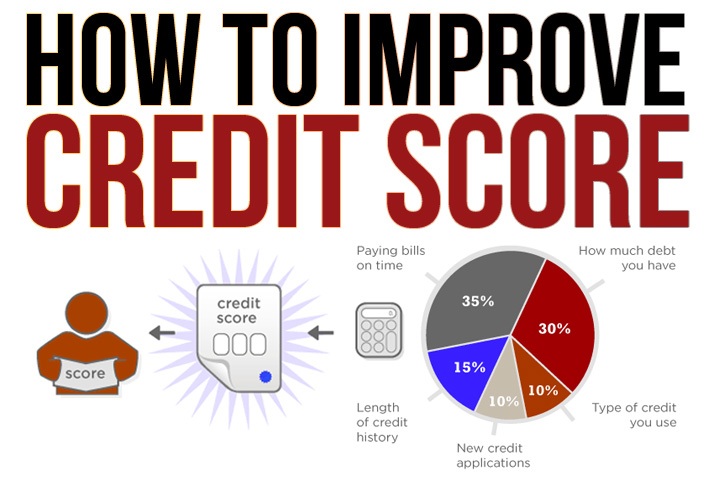

Currently, along with your car loans, you should also be dealing with getting back your credit report. Repairing your credit rating after bankruptcy will be hard with all the financial obligations, so you need to begin little. The very best thing to do is to acquire a small gas card or shop card that calls for minimal costs if any.

Whenever you visit these stores, use the card even if you have the cash money. Obviously, right when you get back to your house, instantly browse the web and also settle the fee digitally. By utilizing the card and also constantly footing the bill immediately, you start to regain your trustworthy appearance.

After several months of revealing true responsibility in handling your payments, you can once more look for more typically made use of credit cards, such as Visa or MasterCard. Still, track all your expenses as well as constantly remain on top of points. The crucial thing is to always pay on time. Even if you have the cash handy, if you do not pay your charge card financial obligations on schedule, you will never ever have the ability to begin restoring credit rating after insolvency.

With a constant income as well as your debt beginning to rise, you can start seeking some correct real estate. Consider home loans, as those are definitely valuable if you're looking to get home. Obviously, you ought to begin tiny, probably absolutely nothing incredible yet.

Buying your very own residence after bankruptcy is very hard, as housing is fairly pricey, and also you'll need to be contributing some money monthly unless you can pay for all of it ahead of time. Due to this, you'll need to be able to maintain a job to supply some constant revenue most importantly your various other needs.

In a manner, every one of these activities links to every various other. After getting a loan, you can continue to start your very own effective company or make an application for paying tasks. Utilizing this money that you earn, you start fixing your credit scores, which will greatly help in the future. With this higher credit history revealing that you're an accountable and also attentive individual, financial institutions will be far more reasonable when you request a mortgage after bankruptcy. As a result of your own committed activities after an insolvency, you'll be able to acquire a wonderful house and possess a much brighter future.

So, your monetary troubles can sometimes be solved by filing bankruptcy to entirely release your financial debts. To learn even more info and discuss it with a knowledgeable bankruptcy lawyer, you can find out more at Fixing Credit History After Personal Bankruptcy.

Ksenia R

April 24, 2021

Cool. It is a very informative article. Thank you.