Your FICO rating is quite possibly the main proportion of your monetary wellbeing. It tells banks initially how dependably you use credit. The better your score, the simpler you will discover it to be affirmed for new advances or credit extensions. A higher financial assessment can likewise make way for the most minimal accessible loan costs when you acquire. If you'd prefer to improve your FICO rating, there are various straightforward things you can do. It requires a touch of exertion and, obviously, sometimes. Here's a bit by bit manual for accomplishing a special financial assessment.

1. Survey Your Credit Reports

To improve your credit, it assists with realizing what may be working in support of yourself (or against you). That is the place where checking your record as a consumer comes in.

Pull a duplicate of your credit report from every one of the three significant public credit departments: Equifax, Experian, and TransUnion. You can do that free of charge once per year through the authority AnnualCreditReport.com site. At that point, audit each report to perceive what's aiding or harming your score.

2. Understand Bill Payments

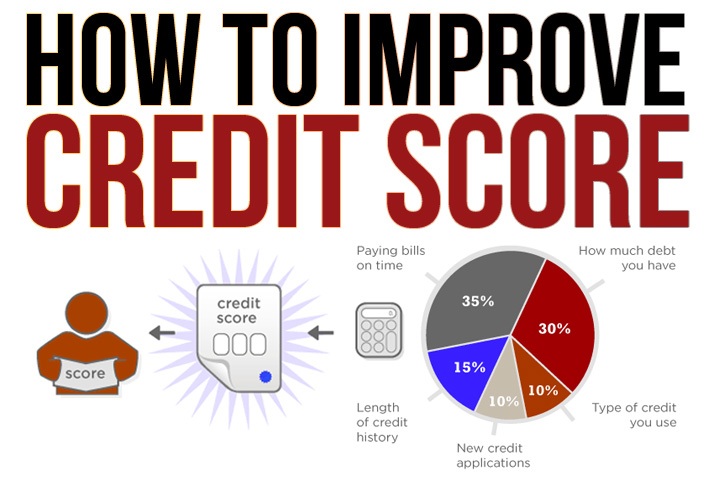

FICO financial assessments are utilized by over 90% of top banks, and they're made out of five specific elements:

• Payment history (35%)

• Credit use (30%)

• Age of credit accounts (15%)

• Credit blend (10%)

• New credit requests (10%)

3. Focus on 30% Credit Utilization or Less

Credit use alludes to the part of your credit limit that you're utilizing at some random time. After instalment history, it's the second most significant factor in FICO financial assessment computations.

4. Cutoff Your Requests for New Credit—and "Hard" Inquiries

There can be two kinds of investigations into your record as a consumer, frequently alluded to as "hard" and "delicate." A regular delicate request may incorporate you checking your credit, allowing a likely boss to check your credit, checks done by monetary establishments with which you as of now work together, and charge card organizations that check your document to decide whether they need to send you pre-affirmed credit offers. Delicate requests won't influence your financial assessment.

why credit and critical to keep a great score

You can use incredible scores into extraordinary arrangements — on advances, Mastercard, protection expenses, condos, and cell plans. Terrible scores can pound you into passing up a significant opportunity or paying more.

The lifetime cost of higher loan fees from terrible or average credit can surpass six figures. For instance, as indicated by financing costs assembled by Informa Research Services:

-

Someone with FICO scores in the 620 territories would pay $65,000 more on a $200,000 contract than somebody with FICOs of more than 760. (FICOs and Vantage Scores are on a 300-to-850 scale.)

-

On a five-year, $30,000 automobile credit, the borrower with lower scores would pay $5,100 more.

-

A 15-year home value credit of $50,000 would cost a low scorer $22,500 more than somebody with high scores.

Since FICO ratings have become an exceptionally fundamental piece of our monetary lives, it pays to monitor yours and see what your activities mean for the numbers. You can construct, shield, and exploit extraordinary credit, paying little mind to your age or pay.

Steps to Improve Your Credit Scores

The particular advances that can assist you with improving your financial assessment will rely on your incredible credit circumstance. Nonetheless, there are comparably broad advances that can help nearly anybody's credit.

1. Accumulate Your Credit File

Opening new records that will be addressed to the immense credit associations—most enormous development prepared experts and card support report to the entirety of the three—is a tremendous beginning stage in building your credit file. You can't begin setting out a pleasant history as a borrower until there are accounts in your name, so having in any two or three open and dynamic credit records can be crucial.

2. Put forth an attempt not to Miss Payments

Your bit history is conceivably the central component in picking your FICO examinations, and having a long history of on-time bits can assist you with accomplishing stunning FICO assessments. To do this, you'll need to promise you don't miss advance or Visa partitions by over 29 days—parcels that are at any rate 30 days late can be addressed to the credit associations and hurt your FICO examinations.

3. Get the ball truly moving With Past-Due Accounts

On the occasion that you're behind on your bills, bringing them current could help. While a late segment can stay on your recognized report for as long as seven years, having the entirety of your records current can be helpful in your scores. Moreover, it holds further late segments back from being added incredibly history comparably as extra late charges

4. Pay Down Revolving Account Balances

Regardless of whether you're not behind on your bills, having a high equilibrium on rotating credit records can incite a high credit use rate and hurt your scores. Revolving accounts combine charge cards and credit expansions, and keeping a low congruity on them close with their credit cutoff centres can assist you with improving your scores. Those with the most basic FICO evaluations will generally keep their credit use degree in the low single digits.

5. Cutoff How Often You Apply for New Accounts

While you may have to open records to make your credit file, you by and large need to restrict how reliably you submit credit applications. Every application can instigate complex sales, which may hurt your scores apiece; at any rate, requests can add up and intensify influence on your FICO assessments. Opening another record will reduce your regular season of documents, and that could, in like way, hurt your scores.

How to add credit lines without hard pull or too many inquiries.

1. Brings down Your Credit Utilization

The FICO credit scoring model will do your FICO assessment if the measure of credit you've utilized is near the aggregate sum of the credit accessible to you. That is because moneylenders believe you to be in danger of assuming exorbitant obligations, making it harder to make future instalments. Regardless of whether these dangers don't concern you, that is the way the scoring model works, and your FICO rating can endure as credit use proportions increment.

2. Less expensive and Easier to Get Loans and Additional Credit

If your FICO rating is higher, you will have a superior possibility of getting affirmed for a Mastercard, vehicle advance, or home loan later on. You'll likewise have an excellent chance of getting a lower loan fee since your financial assessment decides if you'll be offered the best accessible rate or a higher, hazard changed rate.

3. Helps in an Emergency

Having a credit limit well in abundance of your standard spending sum gives you an asset on the off chance that you have a certified crisis that you can't pay for with cash. Let's assume you're voyaging, for instance, and you need to change your arrangements and get back quickly—it most likely will not be modest to change your boarding pass, and it's advantageous to pay for a boarding pass with your Visa.

4. Expands Your Rewards

If you reliably take care of your Mastercard balance in full and on schedule, however, you're not putting the entirety of your costs on your Mastercard; it very well may be an ideal opportunity to begin. Having a higher credit breaking point can assist you with doing that. The customary way of thinking says that you shouldn't charge regular costs like goods and gas to your Mastercard. However, that counsel possibly applies if you're conveying an equilibrium—it's intended to assist you with trying not to aggravate a terrible issue.

5. Let You Make Large Purchases Efficiently

You realize that utilizing your Visa to pay for massive buys is advantageous and can help you pile up remunerations. You cannot deny that your charge card probably incorporates various shopper assurances that can act as the hero if there is an issue with your buy. For instance, MasterCard's insurances include maintenance agreements, value assurance, and inclusion for harmed or taken things. American Express offers comparable advantages.

how to add utility bills and lease

1. Unplug apparatuses and gadgets

Start by unplugging apparatuses, gadgets, and chargers around your home when they're not being used. Numerous basic family things like PCs, TVs, and gaming supports draw energy in any event when they're not turned on, says investment funds master Lauren Greutman. Keeping these things connected constantly could add an extra $100 to $200 per year to your energy bills.

2. Discover approaches to cook without utilizing the broiler

Throughout the mid-year months, turning on the stove can set you back. That is because utilizing your stove to prepare supper or heat-treats can expand the room's temperature by 10 degrees, which can make your cooling kick into overdrive. Using an open-air flame broil or microwave — or setting up no-cook dinners — you could save 2% to 5% on cooling costs.

3. Wash astutely

Regarding water use, a cooler is better if you're hoping to set aside cash, Arcadia says. While doing clothing, for instance, utilizing more relaxed water settings saves energy since about 80% of the energy your clothes washer devours is used to warm the water.

0 Comments

Leave A Comment