We know exactly how important our credit score is, particularly in buying a home. This is among the first things that lending companies inspect when somebody purchases a home loan. They base most of their decisions here. The authorization or displeasure of your funding application will primarily rely on your credit score as this represents your capacity to pay your responsibility. This likewise tells a whole lot concerning just how liable you are.

Apart from the loan approval, the state of your credit history will additionally influence the terms you will have for your mortgage. A lender might still approve your application even if you have a reduced score offered that you make a high down payment. Along with that, you will certainly be provided a higher home loan rate also.

Considering that this is very important, you need to inspect it before looking for finance or perhaps before choosing to purchase a home. You need to do this even if you are current with your payments because there might be mistakes in recording the transactions you made.

Utilize Your Credit Records:

You can utilize your report to inspect your credit scores. The various credit report bureaus will provide you a free copy once a year as called for by the government. Nevertheless, you will need to request it. You can do so by emailing them or composing them a letter. You can also ask for it via their hotline number.

After obtaining the record, assess it. This should not be that tough if you review it frequently. Mark the deals that are wrongly tape-recorded. An instance would certainly be your prompt payment that has been taped late. You likewise have to look for killer deals. You might not know it, but another person might have utilized your details and utilize it for their gain. Highlight these transactions, too, since you may be a sufferer of identity burglary. To check your deals quickly, make it a habit to inspect your expenses. Your costs will specify the purchases you have made in the last month. If there were deals taped that you are not familiar with, call for help today.

When you have marked all the deals you wish to question, prepare your sustaining records. This is why you must maintain records that will certainly help you when you apply for a disagreement. Arrange them effectively to ensure that you will be able to find the correct documents with ease.

When every little thing prepares, prepare a conflict letter. Connect in your letter a xerox of the significant record in addition to the duplicates of your supporting documents. Ensure that you arrange all the documents so that it will certainly be simpler for them to refine your conflict.

Fix Your Credit Score:

Typically, you have a bad credit report because of your own doing. This is why you have to inspect your records for months or even a year before acquiring a house. This way, you will have sufficient time to repair it. If you are late with your month-to-month responsibilities, get a present. If they have already been billed off, pay them. If you encounter financial issues, speak with your financial obligation collector or lender and try to conspire. He can lower your month-to-month payments to make it a lot more inexpensive.

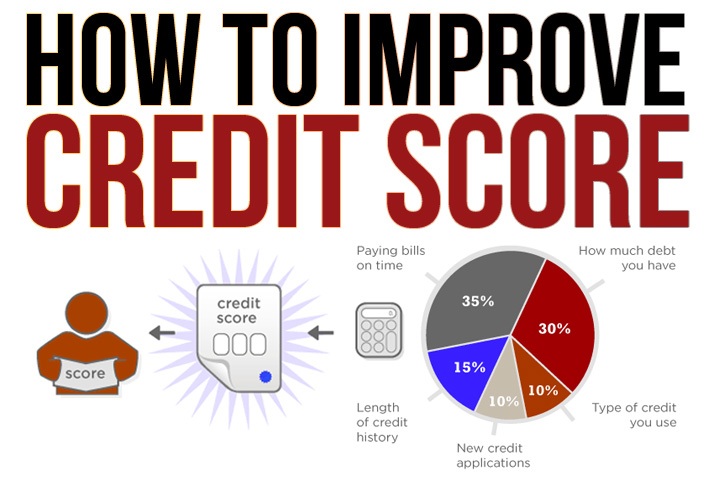

Your score will certainly also depend upon various other elements like using your credit score. Do not max it out, as this can have an adverse result on your rating. If you have many financial obligations, pay several of them first before acquiring a new one.

Mark Dudley

May 5, 2021

If you have impossibly high interest on those credit cards, then do cancel them. It doesn’t help to have open credit cards if the interest rate makes it nearly impossible for you to get the balance down. In fact, banks currently have hardship programs, where they will reduce your interest rate TO ZERO if you agree that they will cancel your cards. Yes, you wll take an immediate hit on your credit score, but that will quickly improve as you pay down your credit cards, which you can now do because you don’t have those usurious interest rates to pay.